The 2024 U.S. presidential election has taken a dramatic turn with Donald J. Trump reclaiming the presidency. This outcome has significantly influenced financial markets, investor sentiment, and economic predictions. How investors are reacting to Trumps win is a key question, as they adjust their portfolios, strategies, and expectations to prepare for policy changes under the Trump administration. This article delves into the immediate reactions, market shifts, and long-term implications of Trump’s win, offering insights into how the global and domestic markets are responding to this pivotal political development.

Market Volatility in the Wake of the Election

Following Donald Trump’s presidential win, financial markets have reacted with heightened volatility, a common response to political shifts with far-reaching economic implications. Investors braced for potential changes to economic policies and trade agreements, creating a surge in both buying and selling activity across markets. This volatility was immediately visible in the stock market, where fluctuations in major indices reflected mixed sentiment as investors tried to assess the future landscape.

Key Points Driving Market Volatility

- Policy Uncertainty: Trump’s pro-business agenda and potential changes in tax rates and regulations have investors both excited and cautious, creating uncertainty that tends to increase market volatility.

- Interest Rate Expectations: With Trump’s plans for economic growth, investors are speculating that the Federal Reserve may adjust interest rates sooner than expected to control inflation, influencing the bond market and driving up yields.

- Currency Movements: The U.S. dollar saw fluctuations as investors considered the impact of Trump’s policies on trade and international relations, with other currencies reacting as well, affecting exchange rates globally.

- Sector-Specific Movements: Certain sectors like energy, infrastructure, and defense experienced a surge, with investors predicting potential growth opportunities from Trump’s policies, while tech and renewable energy stocks saw increased caution.

This post-election volatility represents investor attempts to position themselves favorably amid anticipated policy changes. While some view the shifts as short-term, others consider it a precursor to long-term market trends under Trump’s leadership.

Sectors Poised to Benefit from Trump’s Policies

Donald Trump’s return to the presidency brings a renewed focus on pro-business policies, signaling potential growth for specific industries. His administration’s approach to tax cuts, deregulation, and domestic investment has historically favored certain sectors. With expectations of policy continuity or even expansion, investors are looking closely at industries likely to see significant gains.

Key Sectors Expected to Thrive

Energy Sector

- Trump’s stance on energy independence and fossil fuel production could boost oil, gas, and coal industries, while potentially slowing the push for renewable energy.

- Reduced regulations on offshore drilling and pipeline construction may encourage investment in traditional energy sources.

Infrastructure Development

- Promises of large-scale infrastructure spending could lead to growth in construction, steel, and cement industries, with stocks in companies tied to public works projects expected to rise.

- Transportation and logistics firms may also benefit from improved infrastructure.

Manufacturing and Industrials

- A focus on reshoring jobs and boosting domestic production could help automotive, aerospace, and heavy machinery sectors thrive.

- Tariff adjustments and protectionist policies might give an edge to U.S.-based manufacturers over foreign competitors.

Defense and Security

- Increased defense budgets are likely to bolster military contractors and aerospace companies as Trump reinforces his commitment to national security.

- Cybersecurity firms may see opportunities due to a stronger focus on digital defense.

Financial Services

- Relaxed regulations on banks and investment firms could enhance profitability in the financial sector, with deregulation enabling growth in lending and trading.

Investor Takeaway

These sectors represent significant opportunities for growth as policy shifts align with Trump’s economic priorities. However, investors should remain cautious of potential risks, such as geopolitical tensions or rapid inflation, which could impact the long-term outlook for these industries. Diversifying investments while targeting sectors with strong potential can mitigate risks and capitalize on market momentum.

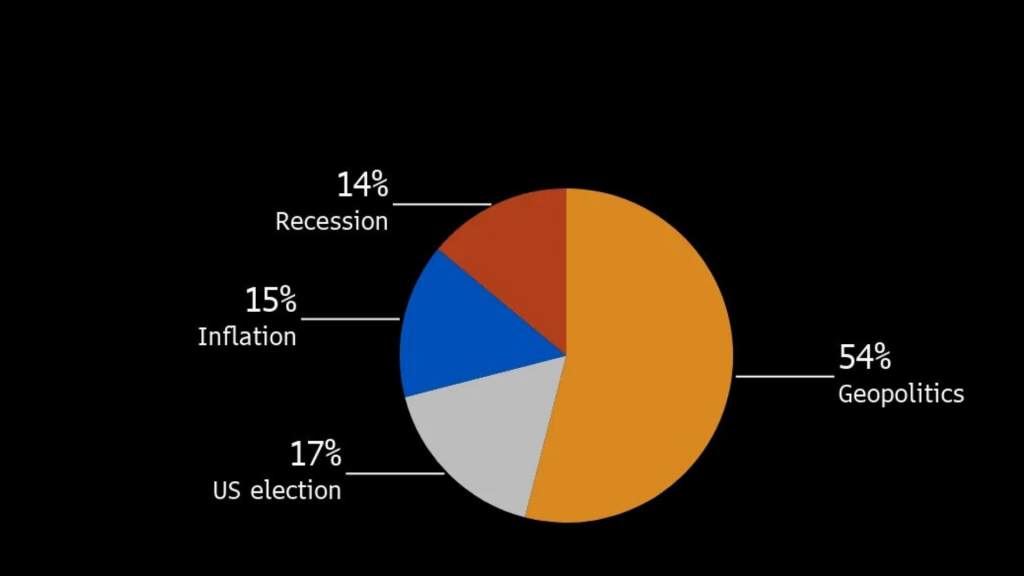

Investor Concerns: Trade, Inflation, and Geopolitics

While Donald Trump’s presidency has sparked optimism in some sectors, it also brings significant concerns for investors, particularly regarding trade policies, inflation risks, and geopolitical tensions. These factors introduce uncertainty, prompting cautious strategies and raising questions about the stability of financial markets under his administration.

Key Concerns for Investors:Key Concerns for Investors:

Trade Policies and Tariffs

- Trump’s history of imposing tariffs on imports and renegotiating trade agreements raises fears of potential trade wars, which could disrupt global supply chains and impact the profitability of companies reliant on international trade.

- Businesses in export-heavy industries, such as agriculture and technology, face risks of retaliatory tariffs from key trade partners like China and the European Union.

Inflation and Rising Costs

- Trump’s focus on stimulating economic growth through infrastructure spending and tax cuts could lead to higher government borrowing, increasing the risk of inflation.

- Inflationary pressures might erode consumer purchasing power, affecting sectors like retail and consumer goods.

- Investors are particularly wary of the Federal Reserve’s response, as higher inflation could lead to interest rate hikes, impacting bonds and debt-heavy companies.

Geopolitical Tensions

- Trump’s stance on foreign policy, including tough rhetoric on China, Russia, and Iran, raises concerns about heightened geopolitical risks.

- Potential conflicts or diplomatic breakdowns could increase market volatility and drive investors toward safe-haven assets like gold and cryptocurrencies.

Supply Chain Disruptions

- Stricter immigration policies and a push for domestic manufacturing may lead to labor shortages and higher production costs, affecting supply chains and profit margins.

Investor Strategies

- Many investors are adopting diversification strategies, allocating funds to safer assets like gold, bonds, and real estate.

- Hedging against inflation with commodities and alternative investments is becoming more common.

- Keeping an eye on global markets can provide insight into how international economies adapt to U.S. policies, helping investors navigate potential risks.

While these concerns pose challenges, proactive investment strategies can help mitigate risks, ensuring portfolios remain resilient amidst economic and political uncertainty.

Stock Market Rally or Recession? Diverging Views on the Economy

Donald Trump’s presidency has historically been associated with mixed reactions from the financial markets. While some investors anticipate a stock market rally fueled by tax cuts, deregulation, and infrastructure spending, others fear the possibility of a recession driven by inflation, trade disputes, or geopolitical instability. This divergence in views reflects the uncertainty surrounding the long-term economic impacts of Trump’s policies.

Arguments for a Stock Market Rally

Pro-Business Policies

Tax reforms and deregulation can increase corporate profitability, boosting earnings per share and driving up stock valuations.

Infrastructure projects could stimulate job creation and consumer spending, supporting overall market growth.

- Sector-Specific Growth

- Sectors like energy, defense, and construction are likely to benefit from targeted spending, driving up their stock prices and lifting market indices.

- Investor Optimism

- Historical patterns show that investor confidence often increases under administrations focused on stimulating economic growth, leading to higher market participation and liquidity.

Concerns About a Potential Recession:

- Rising Inflation

- Expansionary fiscal policies, such as large-scale spending and tax cuts, may lead to higher inflation rates, which could dampen economic growth and reduce the real value of investments.

- Interest Rate Hikes

- The Federal Reserve might raise interest rates to counteract inflation, increasing borrowing costs for businesses and consumers, potentially slowing economic activity.

- Trade Wars and Global Risks

- Trade tensions with key partners like China could hurt export-oriented industries, disrupt supply chains, and create uncertainty for global markets, reducing economic stability.

- National Debt Concerns

- Increased government spending may exacerbate the federal deficit, creating long-term risks for the economy and diminishing the effectiveness of future fiscal interventions.

Expert Opinions:

- Optimists: Pro-growth economists argue that the stock market will likely thrive due to lower taxes, deregulation, and increased corporate earnings. They believe Trump’s policies will create a short-term boom in equities.

- Pessimists: Critics warn of a potential economic bubble driven by inflated stock prices, cautioning that unresolved trade disputes, rising inflation, and debt levels could lead to a market correction or recession.

Investor Takeaway:

Given these diverging views, investors should focus on balanced portfolios, incorporating both growth stocks and defensive assets like bonds and gold. Staying informed about policy developments and market trends is crucial for navigating potential opportunities and risks during Trump’s presidency.

The Role of Interest Rates and the Federal Reserve

Donald Trump’s policies, like tax cuts and infrastructure spending, could trigger inflation, prompting the Federal Reserve to raise interest rates. Higher rates may increase borrowing costs, strengthen the U.S. dollar, and impact trade competitiveness. While sectors like banking may benefit, others, such as real estate, could face challenges. Investors should diversify portfolios, consider safe-haven assets, and monitor Fed decisions to adapt to potential market shifts. Balancing fiscal and monetary policies will be key to navigating risks and opportunities.

Cryptocurrencies and Alternative Investments Surge

| Investment Type | Reason for Growth | Investor Benefits |

|---|---|---|

| Cryptocurrencies | Hedge against inflation and economic uncertainty; high return potential. | Decentralized, inflation-resistant, and highly liquid. |

| Gold and Precious Metals | Safe-haven asset during times of volatility and geopolitical tensions. | Stability, long-term value, and portfolio diversification. |

| Real Estate | Consistent returns, boosted by expected infrastructure growth under Trump. | Tangible asset with potential for steady income. |

| Collectibles and Art | Less affected by market fluctuations; appeal for wealth preservation. | Diversification and potential appreciation in value. |

Global Markets and the International Investor Reaction

Donald Trump’s presidency is influencing global markets as international investors react to potential shifts in U.S. trade policies, economic strategies, and diplomatic relations. The impact is felt across emerging economies, currency markets, and trade-dependent sectors, with some countries benefiting and others facing challenges.

Key Reactions from Global Markets

Emerging Markets

- Emerging economies reliant on exports to the U.S. could face challenges due to potential tariffs and protectionist policies.

- Countries aligned with U.S. economic goals may benefit from stronger bilateral trade agreements.

Currency Fluctuations

- The U.S. dollar often strengthens under pro-growth policies, making exports from other countries more expensive, impacting their trade balance.

- Depreciation of foreign currencies can create opportunities for dollar-based investors in emerging markets.

Trade Relations

- Global investors are monitoring how Trump’s approach to China, the European Union, and other trade partners will affect supply chains and international commerce.

- Companies heavily dependent on U.S. partnerships might see volatility as trade policies evolve.

Sectoral Impacts

- Industries like technology and automobiles, which operate in a global supply chain, may face higher costs or reduced profitability.

- Resource-rich nations could see gains if Trump’s energy policies favor traditional fossil fuel imports.

Implications for International Investors

- Risk Diversification: Shifting investments toward less U.S.-dependent markets or industries to mitigate risks.

- Opportunities in Weak Currencies: Investing in countries with depreciated currencies for long-term gains.

- Focus on Geopolitical Developments: Tracking U.S. relations with major economies to identify market opportunities and threats.

Trump’s policies are reshaping international market dynamics, with significant implications for global investors. Staying adaptable and informed will be key to navigating these changes successfully.

Conclusion

Donald Trump’s presidency has sparked significant shifts in both domestic and global financial markets, presenting a mix of opportunities and challenges for investors. While pro-business policies, deregulation, and infrastructure spending signal growth potential in specific sectors, concerns about inflation, trade disputes, and geopolitical tensions create uncertainty. Investors must remain vigilant, focusing on portfolio diversification, monitoring policy developments, and adapting to market trends to mitigate risks and capitalize on emerging opportunities. As the global and U.S. economies adjust to Trump’s leadership, a balanced approach will be crucial for navigating this dynamic and evolving investment landscape.